Budgeting Out Loud is a concept that involves actively engaging in discussions about your financial planning and management. It’s about breaking the silence that often surrounds money matters and making finances an open, ongoing conversation. While this might seem uncomfortable, it’s a powerful method that can help improve your financial knowledge base and challenge cultural and social norms.

Past generations believed it was rude or inappropriate to discuss money matters in public or even in the home. Whether this was from the point of view that finances are a private matter or the potential shame and embarrassment that could stem from the comparing of financial status, it’s time to break the stigma.

WHY DO WE NEED TO TALK ABOUT MONEY?

- It improves financial literacy: Regular discussions about money can help you understand your finances better. Concepts like budgeting, saving, and investing become more familiar, making it easier to manage your money.

- It highlights opportunities: Open conversations about wages can bring to light opportunities and discrepancies when it comes to earning potential and wage gaps.

IMPROVING FINANCIAL LITERACY: BUDGETING FOR STUDENTS

Managing your finances as a student requires discipline, planning, and smart decision-making. Avoiding common budgeting and spending mistakes and developing responsible money management habits will help you make the most of your student years. Graduation will be a lot more promising if you are financially stable and ready to take on your new career. Here’s some advice, information, and financial tips from our partners at Enriched Academy for students, to help get your finances in order.

Managing your finances as a student requires discipline, planning, and smart decision-making. Avoiding common budgeting and spending mistakes and developing responsible money management habits will help you make the most of your student years. Graduation will be a lot more promising if you are financially stable and ready to take on your new career. Here’s some advice, information, and financial tips from our partners at Enriched Academy for students, to help get your finances in order.

What is the first step to effective money management for students?

While studying, consider your long-term financial goals and how education costs and debts can impact your future lifestyle. For instance, estimate your student loan repayments if you plan to buy a home or car post-graduation. Remember, student loans need repayment six months after graduation. Relying heavily on student debt, hoping for a high-paying job post-graduation, can lead to financial strain. If student loans are necessary, borrow only what you need and understand the terms and interest rates.

How can I handle my student loans responsibly?

The average Canadian student loan is about $15,000 for a 2-year college and $28,000 for a 4-year degree. Repayment is flexible but declaring bankruptcy within 7 years of graduation doesn’t forgive student loans and can severely impact your lifestyle. While education debt is often unavoidable, it’s important to limit borrowing. Keeping costs low as a student can position you better financially post-graduation. Always seek scholarships, grants, or financial aid to reduce student debt.

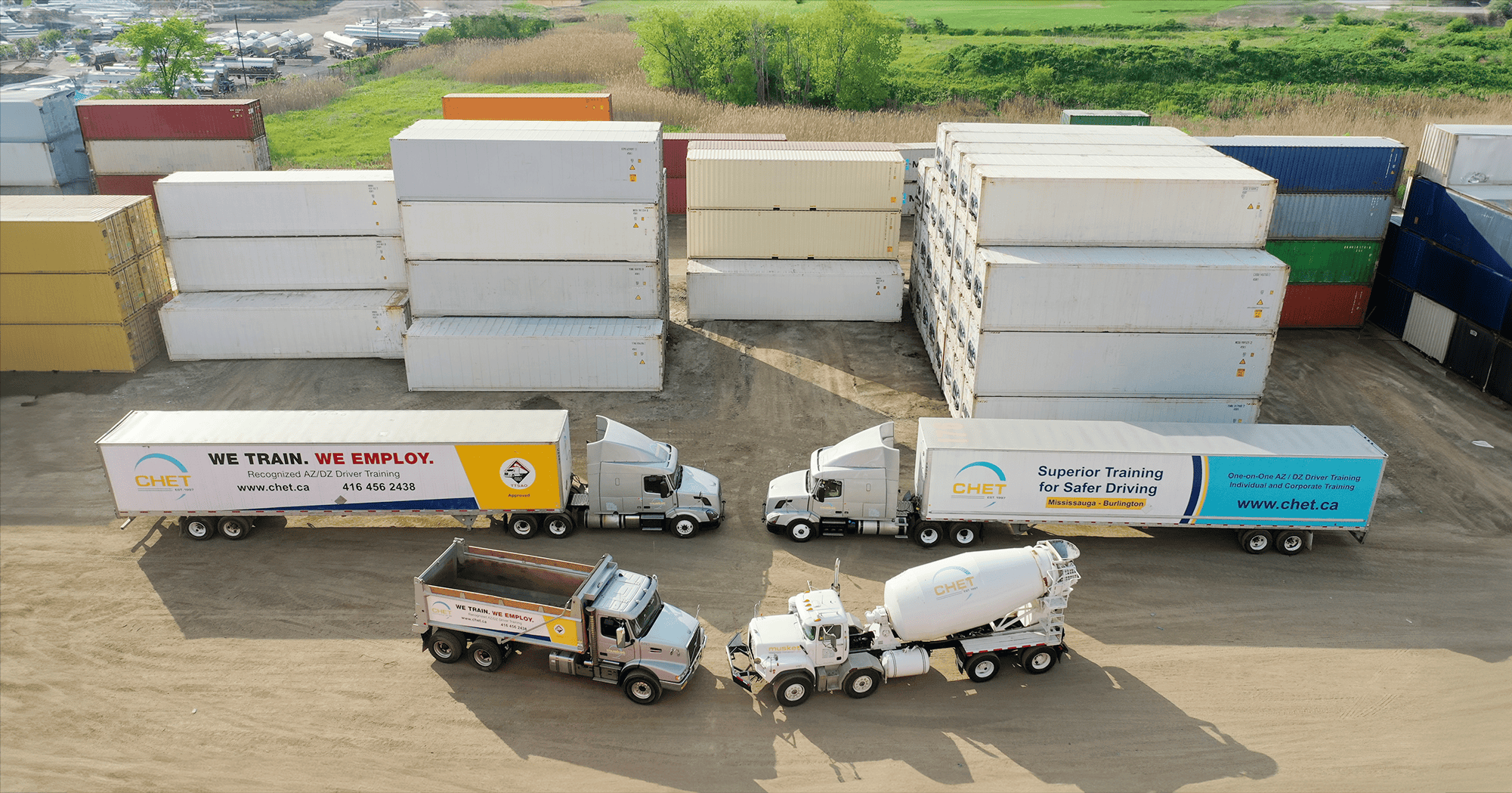

It’s important to note that should you train at CHET, our loan partner LendCare provides below the average student loan for a 2-year commitment.

What are some common budgeting mistakes students should avoid?

A common mistake is not budgeting, causing overspending and financial mismanagement. Students should use their initial funds, from loans or jobs, to cover major expenses like tuition, housing, and school supplies. Also, anticipate travel expenses for holiday breaks. After addressing these costs, distribute the remaining money monthly or weekly. Avoid running out of funds before the academic year ends.

How do I create a realistic student budget?

Effective money management requires tracking all expenses and categorizing them to maintain a continuous understanding of your financial position. Use convenient tools like finance apps, spreadsheets, or even paper. Update your tracking system regularly. Adjust your budget as needed, but avoid unplanned debt. Be mindful of impulse purchases and distinguish between essential and non-essential items. Leverage student discounts and opt for free or low-cost events and services. Cook at home and limit dining out. If you share expenses, ensure a fair distribution and timely payment.

How can I build and maintain a good credit score as a student?

That shiny new student visa card you got from the bank is a great thing to have, but you need to pay it off every month by the due date. In fact, using your credit card for a few purchases each month and paying it off on time will help to establish your credit rating. Paying back your student loans after graduation will also help greatly with your credit rating.

What are some practical ways to save money as a student?

Even as a student, saving a small amount monthly in a tax-free savings account can be beneficial. These accounts are easy to open, and the $6500 annual limit applies to everyone. Regular contributions can grow into a substantial amount by retirement. Consider part-time work or freelancing to increase your income, but avoid overworking. Estimate your income conservatively, and allocate some savings for emergencies to limit reliance on credit.

HIGHLIGHTING OPPORTUNITIES: AN ABOVE THE NATIONAL AVERAGE STARTING WAGE

In the driving profession, rates are consistent across the board, providing more than fair equality from a pay standpoint. According to Talent.com, the overall average entry-level salary for Ontario is $46,800.00. However, a new driver, with a company like Musket Transport, could potentially earn anywhere from $60,000.00 to $80,000.00 within the first year.

Now, let’s dive into some practical tips tailored for drivers, to help ensure you’re the most profitable you can be:

Embrace every opportunity for further training and education:

In an ever-evolving industry, it’s crucial to stay updated with the latest trends and technologies. Different lanes and equipment can offer a wealth of knowledge and expertise that can substantially enhance your skill set. This not only makes you a more competent professional, but exponentially increases your marketability in the competitive job market. Remember, continuous learning is the key to remaining relevant and successful in your field.

Communicate professionally and calmly:

The importance of interacting with various stakeholders in a professional manner cannot be overstated. This includes individuals such as dispatch personnel, maintenance crews, and, most importantly, customers. By maintaining a calm and professional demeanor, you not only boost your personal reputation but also foster stronger relationships. This approach can lead to more effective collaboration, improved customer satisfaction, and overall, a more positive work environment.

Ensure you arrive ahead of your scheduled dispatch time:

This practice is not only professional, but it also provides you with ample opportunity to thoroughly conduct a pre-trip inspection. By doing so, you can identify and address any potential issues with the vehicle that may have otherwise been overlooked. This proactive approach can significantly reduce the risk of experiencing an unexpected breakdown while on the road, ensuring a smoother and safer journey for you.

Adopt flexibility with divisions:

In any working scenario, it’s quite possible that one division might be busier than the other. Instead of seeing this as a setback, visualize it as an opportunity. You should always be open and ready to switch your working division if necessary. By doing so, you will not only keep yourself engaged and productive, but also continue to earn a competitive amount, thereby maintaining your income levels. This approach ensures that your earning potential is not compromised, even when the workload fluctuates between different divisions.

Take the time to attend regular driver meetings and make a point of familiarizing yourselves with management:

In any business, it’s essential to be proactive and involved. This is particularly true in a dynamic and fast-paced environment like ours. By attending driver meetings regularly, not only will you be kept abreast of the latest company news and updates, you can also take the opportunity to voice your thoughts and opinions. Moreover, familiarizing yourself with management is a key step towards increasing your visibility within the company. It helps you create a strong professional network and opens up potential avenues for growth and advancement. It’s not just about climbing the corporate ladder; it’s about actively shaping and influencing the direction of the company through your unique perspective and insights.

Understanding and managing your finances, whether you’re a student or a professional, is key to achieving financial security. Open discussions about money, effective budgeting, and strategic saving habits are crucial steps towards this goal. Keep in mind that it’s not just about what you earn, but also about how you manage, save, and grow your money. Let’s break the stigma, start the conversation about money, and drive towards a more financially literate society.