CHET students, trainers and administrators receive full access to Enriched Academy platform and resources through a new partnership.

Financial literacy in any walk of life can be a difficult thing to grasp. Many secondary institutions don’t teach any sort of practical applications when it comes to managing finances and understanding the ins and outs of being fully financially literate. Through a recent strategic partnership, CHET students will now have access to education and resources in this important area.

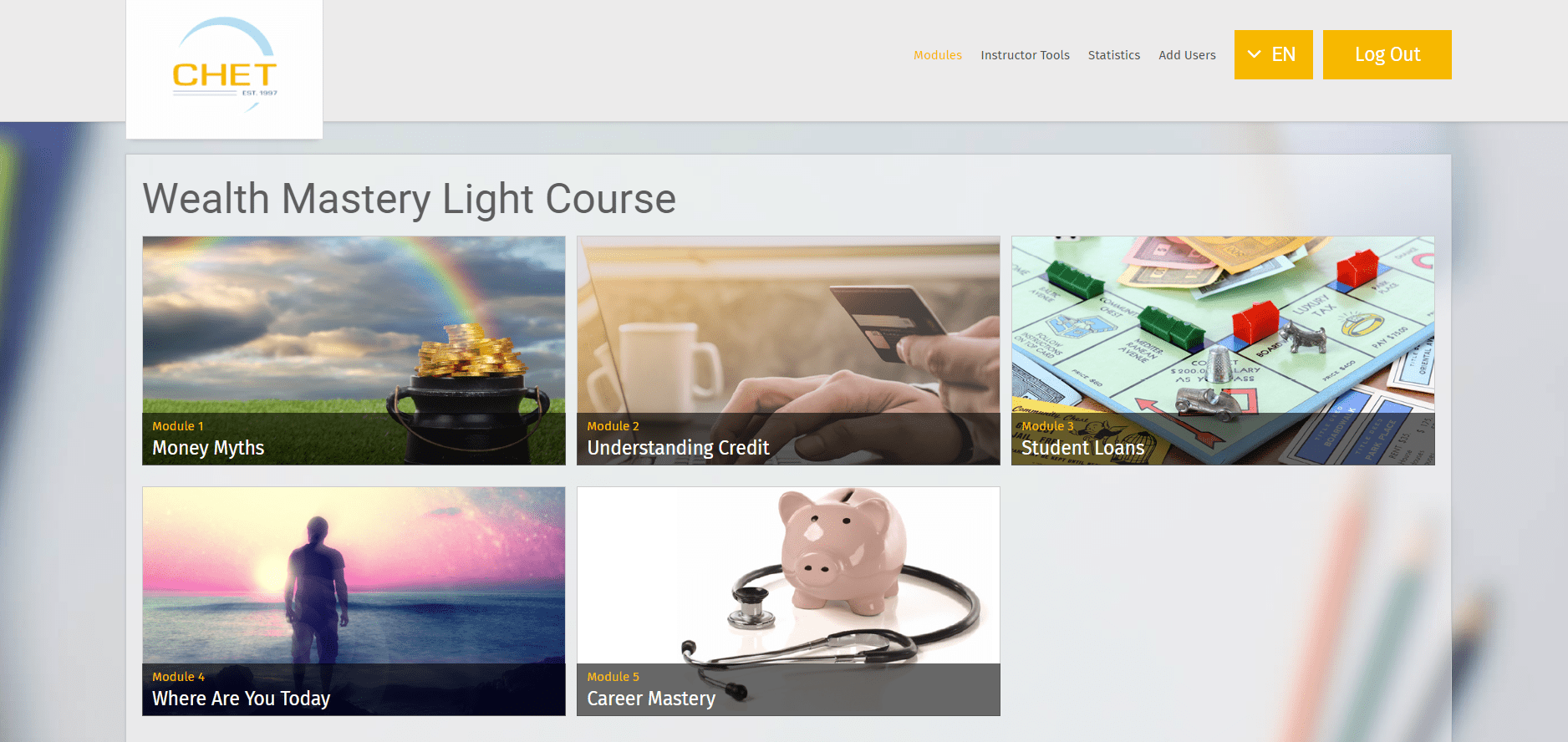

Canada’s #1 financial literacy resource is partnering with CHET to add financial educational videos, tools, and platforms to CHET’s already impressive training curriculum.

“Enriched Academy is very excited to be working with CHET and helping them add these critical financial life skills to their training programs,” stated Desmond O’Dell, Regional Director of Education for Enriched Academy. “Not only will CHET trainees receive industry-leading commercial truck driver training to launch their new careers, but they will also have the knowledge, skills, and tools to effectively manage their personal finances and start building a solid financial future.”

“Enriched Academy is very excited to be working with CHET and helping them add these critical financial life skills to their training programs,” stated Desmond O’Dell, Regional Director of Education for Enriched Academy. “Not only will CHET trainees receive industry-leading commercial truck driver training to launch their new careers, but they will also have the knowledge, skills, and tools to effectively manage their personal finances and start building a solid financial future.”

“The trucking industry is no exception when it comes to the need for financial literacy,” shared Communications Manager for Enriched Academy, Mark Parker. “You invested a lot of time, effort and money to acquire the skills and knowledge needed to carry out the job and earn a paycheque, but have no idea how to make that paycheque work for you. The hours can be long, your income may fluctuate, you may be self-employed — all of these can make the need to manage your money effectively even more critical. Financial stress can also seriously affect your concentration and performance behind the wheel. Having readily accessible training and education resources you can rely on when it comes to managing your financial life is a game changer that will allow you to save time, save money and eliminate stress for you and your family about your financial future.”

“Better financial understanding by itself will not solve your money issues but… just a little pre-emptive knowledge can make a huge difference.”

Enriched Academy has been in business since 2002 when they first began making presentations in high schools. In 2015, they added adult education programs and have been working with private career colleges, like CHET, for over 6 years, partnering with over 250 companies and schools across Canada.

Enriched Academy’s courses are entertaining, authentic, and easily relatable to real-life scenarios so students can benefit from a useful ongoing skillset.

This comes as great comfort to many students who may be struggling or have struggled with financial literacy in the past. Musket driver, Michal Szewcyzk comments on the financial management struggles of being an owner-operator in the industry.

“If somebody is going to go for a used truck, they basically have to have the money for the truck if they’re going to pay it outright full,” said Szewcyzk. “That’s in the used truck market side. On the new truck side, it used to be different pre-COVID. Pre-COVID, you’d have to put down only $2,000 or $5,000 to secure and place an order… [Now] a brand new truck is, let’s say $260,000. You have to give 20% upfront in order to sign the agreement. Times have changed.”

CHET students, trainers, and administrators for the school will receive full lifetime access to the Enriched Academy platform and resources that will better help students coming out of CHET manage their new financial life in the trucking and transportation field. And what that looks like will be different for everyone.

Szewcyzk went on to say, “When somebody new is going to come into the trucking business as a company driver or an owner-operator, they’re going to see a huge increase in their paycheck, but they have to manage their funds. They have to figure out what they want to do with those funds, whether it’s going to be saving for a down payment for a house or paying off existing debts or loans or, you know, jumping out and buying a new Harley or a sports car.”

Parker also commented, “Better financial understanding by itself will not solve your money issues, but the importance of financial literacy cannot be overstated. We have seen over and over again at Enriched Academy how just a little pre-emptive knowledge can make a huge difference.”

TOP TIPS:

1. Investing is key

One of the biggest mistakes people make is sitting on cash and failing to invest, which is a sure-fire way to lose the battle with inflation. We know…. financial markets can be intimidating and risky, but self-directed investing is now very common. It’s cost-effective, and a “robo-advisor” or “all-in-one ETF” are readily available and can make getting started and managing risk a pretty hands-off process.

2. Crush your highest interest debt first

Another issue causing a lot of financial grief these days is high interest rates — a mortgage payment, line of credit, or car loan will all cost a lot more in 2023 and it is time to dig in on the cost of debt. If you have multiple loans, look into the interest rates and focus on the debt causing you the most pain. In almost every case it is credit cards that lead the way, and you should attack that balance first. However, you may also want to rethink that 7-year new car loan or kitchen reno once you do the math and see how much it is going to cost over the years at 6% interest!

Learn more about Enriched Academy on their website.